THE HALVING IS NIGH

If the demand for new bitcoins stays constant and the supply of new bitcoins is cut in half, this will force the price up. There has also been an increased demand for bitcoin before the halving event because of the anticipation of a price increase.

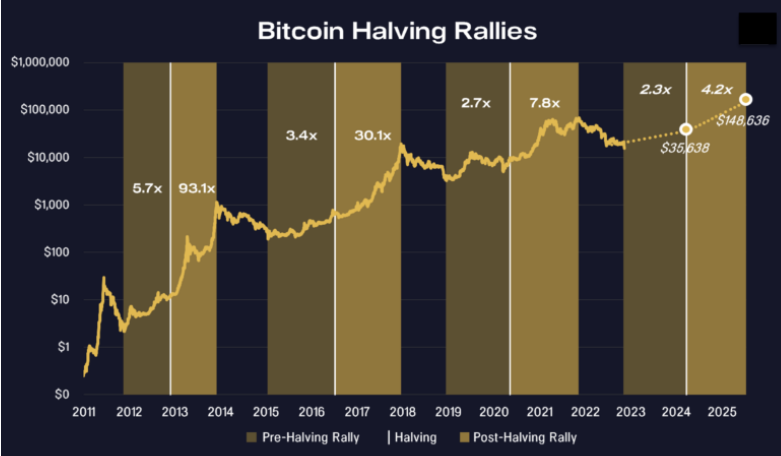

Over the years we have stressed that the halving is a big event – but it takes years to play out. The typical trough is 1.3 years before the halving and, on average, the market peaks 1.3 years after. The whole process has taken 2.6 years to see the full impact.

Bitcoin has historically bottomed 477 days prior to the halving, climbed leading into it, and then exploded to the upside afterwards. The post-halving rallies have averaged 480 days – from the halving to the peak of that next bull cycle.

how can we help you?

Stay in the know

Stay abreast of the latest news, insights, and trends in crypto.

IF history were to repeat itself, the price of bitcoin would trough November 30th, 2022. We would then see a rally into early 2024 and then a strong rally after the actual halving. The following chart shows what might happen if Bitcoin repeats the performance around previous halvings.

BITCOIN HALVING :: STOCK-TO-FLOW PRICE PROJECTION

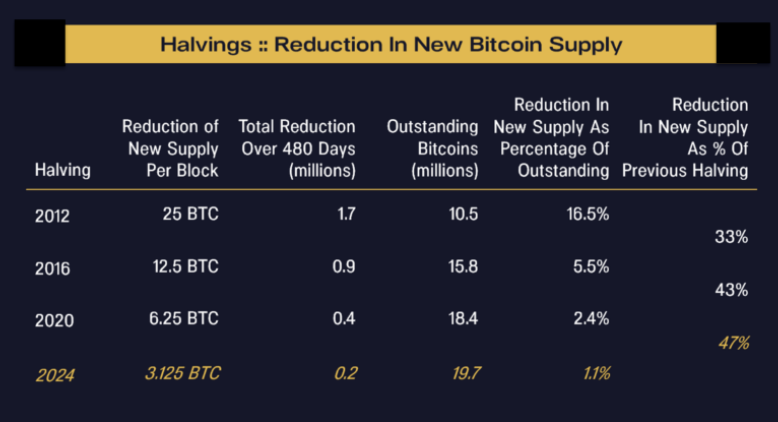

The framework we’ve used for analyzing the impact of halvings is to study the change in the stock-to-flow ratio across each halving. The first halving reduced the supply of new bitcoins by 17% of the total outstanding bitcoins. That’s a huge impact on new supply and it had a huge impact on price.

Each subsequent halving’s impact on price will likely taper off in

importance as the ratio of reduction in the supply of new bitcoins from previous halvings to the next decreases. Below is a chart depicting past halvings’ supply reductions as a percentage of the outstanding bitcoin at the time of the halving.

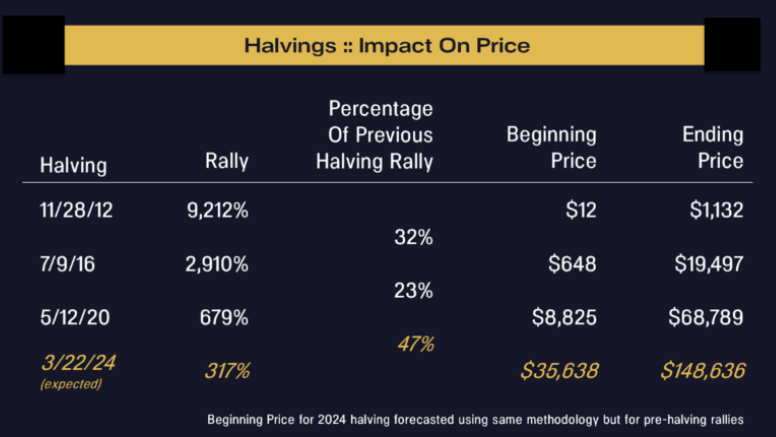

The 2016 halving decreased the supply of new bitcoins only one-third as much as the first. Interestingly, it had exactly one-third the price impact.

The 2020 halving reduced the supply of new bitcoins by 43% relative to the previous halving. It had a 23% as big an impact on price.

The next halving is expected to occur on March 22, 2024. Since most bitcoins are now in circulation, each halving will be almost exactly half as big a reduction in new supply. If history were to repeat itself, the next halving would see bitcoin rising to $36k before the halving and $149k after.