How to Day Trade Crypto

What is Day Trading?

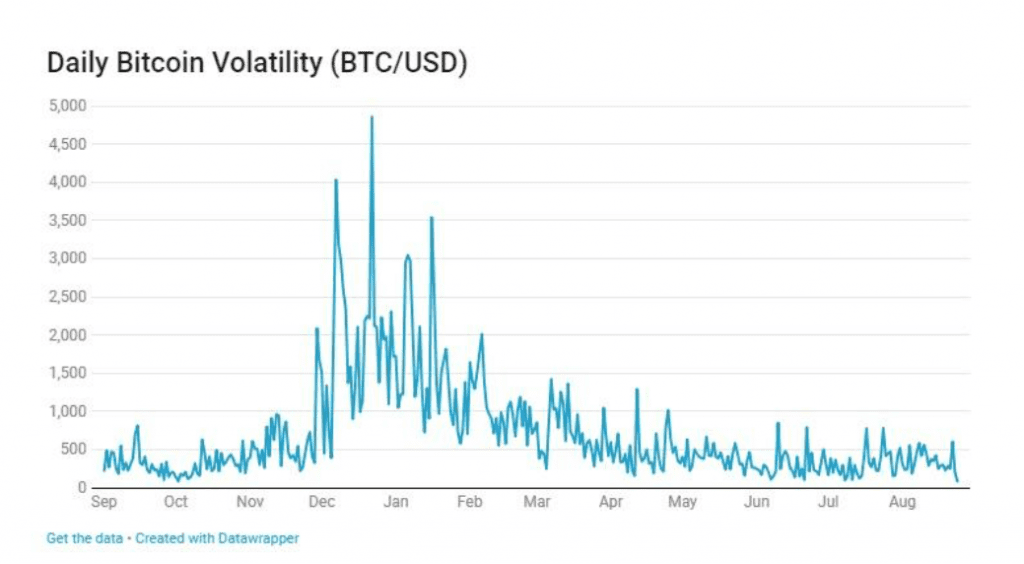

Day trading crypto can be attractive because of the volatile nature of the various currencies’ values. Crypto can fluctuate 5-10% or more in a single day and the crypto markets are generally open 24/7, unlike traditional markets.

When the demand for a cryptocurrency nears or outstrips its supply, its value rises. When many more coins are available than are being purchased, the value falls. Sometimes, a team of managers or automated processes help set the value, releasing more of a currency when the price gets too high, or they begin “burning” coins – sending them to a blockchain address where the coins can’t be recovered when it falls.

And while the average annual U.S. stock return of 10% becomes 6-7% after it’s adjusted for inflation, crypto can still rise and fall much farther and faster in a single day. Day trading is a set of techniques used to take advantage of short-term changes in the prices of a commodity. As the name implies, the goal of a day trader is to end any given trade with their holdings having a higher value than they started with.